Our Principles

Guided by Excellence

Excellence is the path we choose to follow. Our proven processes reflect a deep commitment to quality in every aspect of our service.

The Freedom to Offer What’s Best

Our complete independence from banks and other financial institutions, combined with the wide range of options we manage, allows us to offer truly tailored solutions—with an unwavering commitment to each client’s best interests.

Growing Your Wealth Is Our Mission

We’re dedicated to helping our clients grow and protect their wealth, with strategies that are thoughtfully designed to evolve with their lives, ambitions, and ever-changing needs.

Innovation That Moves Us Forward

We stay ahead of the curve by embracing the latest technologies and trends—ensuring our services are always one step ahead.

One Client, One Unique Solution

Every client has their own vision, needs and goals. At Andes, we’re here to create a tailored path that stays true to their expectations, every step of the way.

Time: Our Initial Investment

We dedicate time to deeply understanding each client, respecting confidentiality, and using meticulous processes that allow us to create the precise profiles and portfolios needed to achieve outstanding results.

A Unique Formula in Every Proposal

Each investment proposal is a carefully crafted, strategic combination, designed to reflect the goals and exceed the expectations of every client.

GLOCAL Capability

The best of both worlds. We offer the perfect blend of deep knowledge and experience in international markets, combined with the ability to manage it all right from here—always close, always connected.

Relationships That Grow

Getting to know each client is an ongoing process that evolves every day. We believe in the long-term, building mutual trust over time.

Trust Built on Professionalism

We believe personal relationships are rooted in the strength of our professional interactions, not the other way around. We value the time it takes for these connections to grow authentically, driven by the excellence of our work.

We are Andes

Excellence in Global Wealth Management

We specialize in managing the wealth of high-net-worth families, institutions, and corporations. With a deep understanding of global markets, we provide highly tailored services that meet the unique needs of each client.

Our approach blends thorough analysis with the ability to stay ahead of market trends through world-class investment strategies. We pride ourselves on being the trusted partner that safeguards and grows our clients’ wealth, always with transparency and precision.

Why Andes?

A Strategic Partner.

Transparency is our core commitment, aligning our interests with those of every client.

By operating with complete independence, our recommendations are free from hidden interests or external commitments.

Each strategy is crafted with rigor and creative vision, tailored exclusively to reflect the uniqueness of each client and their risk profile—without shortcuts.

Our journey and strong presence in global markets, with access to over 40 asset classes, make us experts at identifying unique investment opportunities that far exceed those available in the market.

We handle complex investments, designing investment policies that meet the most demanding scenarios. Our ability to navigate multifaceted situations makes us a trusted ally in managing your wealth.

We stay ahead of global trends by incorporating advanced technologies and precise investment strategies, ensuring your portfolio remains current and competitive.

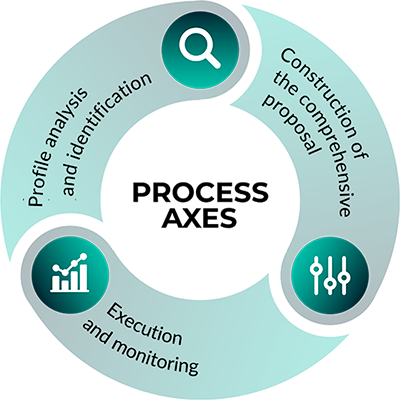

Our Process

Precision, Transparency, and Results

At Andes, every step we take is carefully planned and executed with a disciplined, by-the-book approach. From initial analysis to counterparty efficiency and portfolio construction, we apply the highest standards of wealth management—ensuring every decision is backed by deep, rigorous analysis.

Our mission is to protect and grow each client’s wealth with full transparency, true independence, and an unwavering commitment to excellence.

Services

Comprehensive Wealth Management for High-Net-Worth Families

Our Multi-Family Office service is designed to provide sophisticated offshore wealth management, addressing the unique needs of each family. With complete independence and a wide range of options, we offer access to global investment opportunities, ensuring truly personalized solutions without hidden interests.

What Do We Do for Your Family?

Risk Profile Analysis & Definition

We conduct a detailed analysis of each family member's risk profile, ensuring that our investment strategies are fully aligned with their goals and expectations.

Cost Structure Analysis

We conduct a thorough analysis of the cost structure for each financial institution the family works with. From there, we propose changes that lead to greater efficiency and improved service quality.

Investment Policy & Family Governance

We help families build solid governance structures by setting up Financial Committees and other key decision-making bodies. This ensures a strategic, well-aligned approach to managing wealth. We also design a tailored Investment Policy that takes into account tax considerations, liquidity needs, investment horizons, and diversification goals.

Collaborative Decision-Making

We hold monthly performance reviews and quarterly investment committee meetings to track portfolio progress, respond to market shifts, and ensure your strategy stays ahead of the curve.

Global Vision with Broad Diversification

We provide access to a full range of global investment opportunities, ensuring the freedom to choose the best solutions with no hidden interests or restrictions.

International Portfolio Design & Management

We build globally diversified portfolios tailored to each client’s profile, drawing from a wide spectrum of investment options. Portfolios are continuously monitored and optimized to ensure they’re always positioned to capture the best opportunities in the market.

Tax Optimization & Estate Planning

We develop tax strategies that enhance efficiency and safeguard wealth against legal and fiscal complexities. Our advisory includes estate structuring, succession planning, and the creation of corporate vehicles to ensure long-term continuity and protection of the family legacy.

Financial Education for Future Generations

We place strong emphasis on educating future generations in financial management, fostering responsibility and stewardship to ensure the long-term sustainability and continuity of family wealth.

Investment Management for Institutions

We offer highly specialized wealth management services tailored to the unique goals of each institution. Our approach stands out for delivering conflict-free investment solutions, with full access to a wide range of global opportunities, always aligned with the institution’s risk profile and liquidity needs.

How Do We Manage Institutional Wealth?

Defining Objectives & Risk Mandate

We work closely with each institution to define investment goals and risk tolerance, establishing a clear risk budget to guide strategy and decision-making.

Building the Decision-Making Framework

We support the creation or strengthening of governance structures to ensure effective, transparent, and aligned decision-making processes.

Developing the Investment Policy

We draft a comprehensive investment policy that takes into account tax impact, liquidity requirements, investment horizon, and diversification strategies—always tailored to the institution’s specific goals.

Portfolio Design & Construction

We build investment portfolios aligned with the defined risk budget and mandate, leveraging our global market expertise to offer access to opportunities that few others can match.

Our independence ensures we select only the best options—free from hidden interests or ties to financial institutions.

Ongoing Monitoring & Rebalancing

We continuously monitor adherence to the risk budget, recommending rebalancing as needed to keep the portfolio aligned with the investment policy and market conditions.

Performance Review & Accountability

We conduct regular performance review meetings to ensure ongoing, transparent communication and clear accountability.

Cost Optimization

We handle fee negotiations with third parties to secure the most favorable and cost-effective conditions for your institution—reflecting our full commitment to your best interests.

Strategic Advisory & Ongoing Support

Our highly specialized team is always available to provide ongoing advice and strategic support, ensuring your investment approach remains forward-looking and responsive to market changes.

Working Capital Management

Our Onshore and Offshore Working Capital Management service is designed to support the finance and treasury teams of both local and international companies. We help optimize resources and turn working capital into an additional source of return. With a strategic and tailored approach, we offer solutions that align with the unique needs of each company—delivering effective and sustainable results.

What Do We Do for Your Company?

Working Capital Optimization

We work closely with CFOs and Treasury teams to identify and implement strategies that optimize working capital, ensuring resources are used efficiently and contribute to the company’s growth.

Strategic Cash Surplus Management

We develop tailored strategies for managing excess cash, fully aligned with your company’s cash flow needs. This ensures liquidity is always available and used in the most efficient way.

Diversified Portfolio Construction

We design and manage diversified portfolios focused on total return, aligned with the company’s financial objectives. These portfolios are built to adapt to changes in exchange rates, inflation, and interest rates—prioritizing both stability and performance.

Continuous Monitoring & Evaluation

We provide ongoing oversight of both working capital management and associated investments, ensuring alignment with corporate goals and responsiveness to market dynamics.

Financing Alternatives Analysis

We conduct a thorough analysis of available financing options—ranging from traditional banking solutions to capital market instruments, including debt issuance. This helps your company choose the most suitable option for its financial needs and capital structure.

Regular Performance Meetings

We organize periodic meetings with your finance teams to review working capital performance and adjust strategies as needed, ensuring ongoing communication and strategic alignment.

Our Team

Meet Our Founding Partners

With over 25 years of experience in investment management, Luis has been a key figure in portfolio management for major institutions—including banks, investment funds, pension and retirement fund managers, insurance companies, and family offices. His deep knowledge of the financial sector and strategic design skills are vital to the firm.

Throughout his career, Luis has demonstrated an unwavering commitment to excellence, leading the wealth management efforts of high-net-worth families and institutions, always with a focus on protecting and sustainably growing their assets.

Luis also brings a strong academic background, having served for 15 years as a tenured professor of Portfolio Management in both undergraduate and graduate programs at Universidad de San Andrés. He has also taught the subject at Universidad Austral in Rosario and IAE Business School. Today, he continues to educate the next generation of financial professionals through his MBA course at Universidad Torcuato Di Tella.

He holds a degree in Economics, a Master’s in Finance, and the certifications of Certified EFFAS Financial Analyst, Certified International Investment Analyst (CIIA), and Ibero-American Financial Analyst—highlighting his dedication to the highest standards of professionalism in the industry.

With more than 25 years in the financial system, Santiago brings invaluable experience in managing corporate banking relationships and optimizing financial strategies for families, large corporations, and institutions. During his banking career in Argentina—where he led the Corporate Banking division for over a decade—Santiago established himself as an expert in delivering customized financial solutions that maximize client value.

Santiago holds a degree in Economics, and his strategic mindset and deep understanding of the markets enable him to design robust, effective financial solutions that align with each client’s goals for growth and wealth protection.

His commitment to excellence, leadership skills, and results-driven vision are essential to Andes WM’s success.

Karem brings a unique blend of deep mathematical expertise and strategic vision to the world of wealth management. She holds a Bachelor’s and PhD in Mathematics from the National University of Córdoba, along with a Master’s in Finance from the University of San Andrés. Her strong academic background and analytical mindset drive innovative solutions in portfolio optimization and risk management.

As Chief Operating Officer, Karem oversees the firm’s day-to-day operations, ensuring excellence across all processes. She leads the implementation of high-standard service protocols and integrates advanced technologies to enhance our financial strategies and deliver sustainable results.

Beyond her role at Andes WM, Karem is also a dedicated educator. She teaches at the University of San Andrés and Torcuato Di Tella University, where she leads courses in Python, Stochastic Processes, and Portfolio Management—sharing her knowledge and shaping the next generation of finance professionals.